Metro integration with Flavor

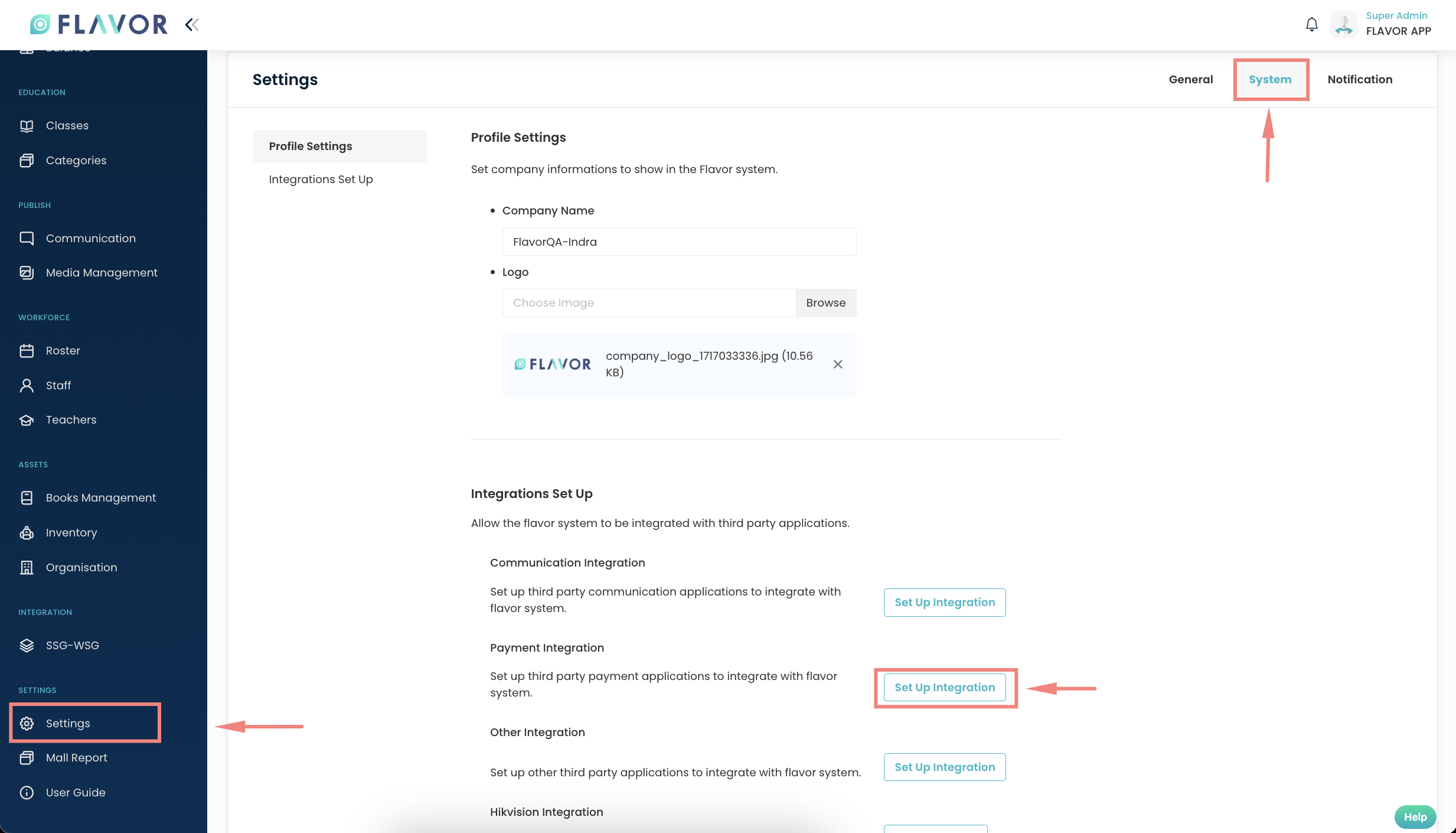

Step 1

- Go to the Setting from the left side menu of the Flavor System.

- Click on the System.

- Go to Payment Integration and click on Set up Integrations.

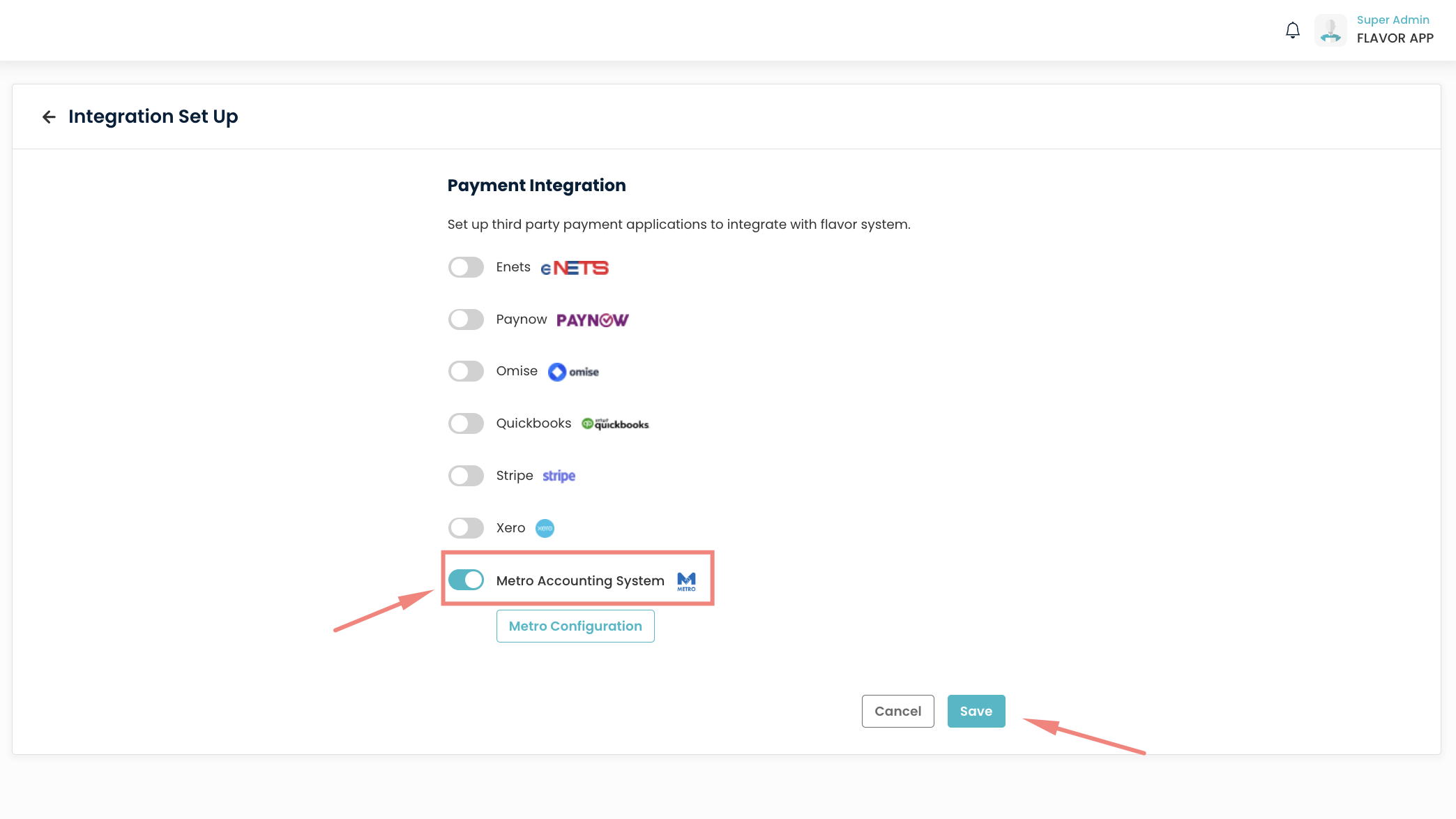

Step 2

- Enable Metro Accounting System setting.

- Click on Save.

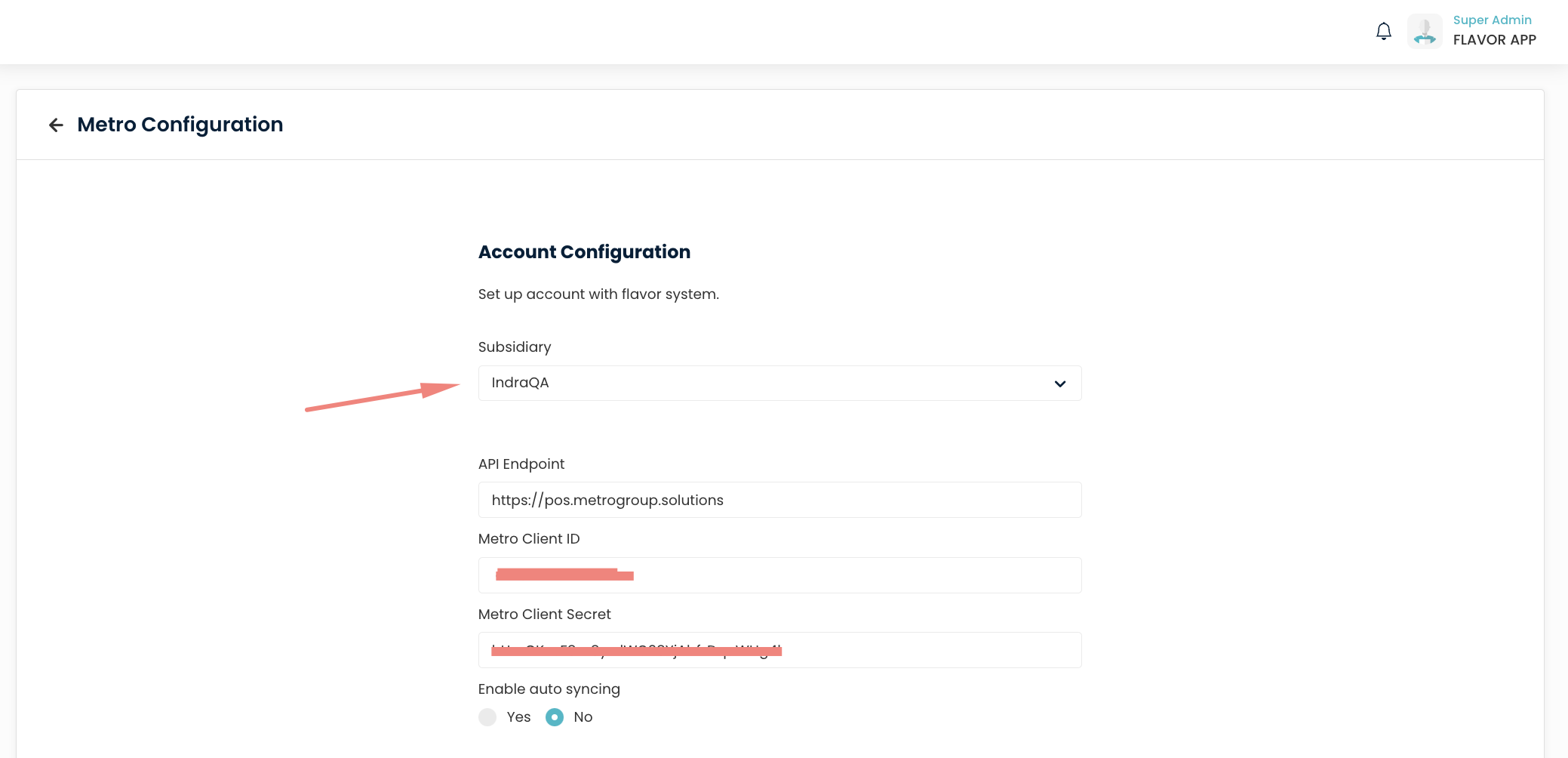

Step 3

- Click on Metro configuration.

- Select the Subsidiary.

- Fill in valid API Endpoint, Metro Client ID & Metro Client Secret.

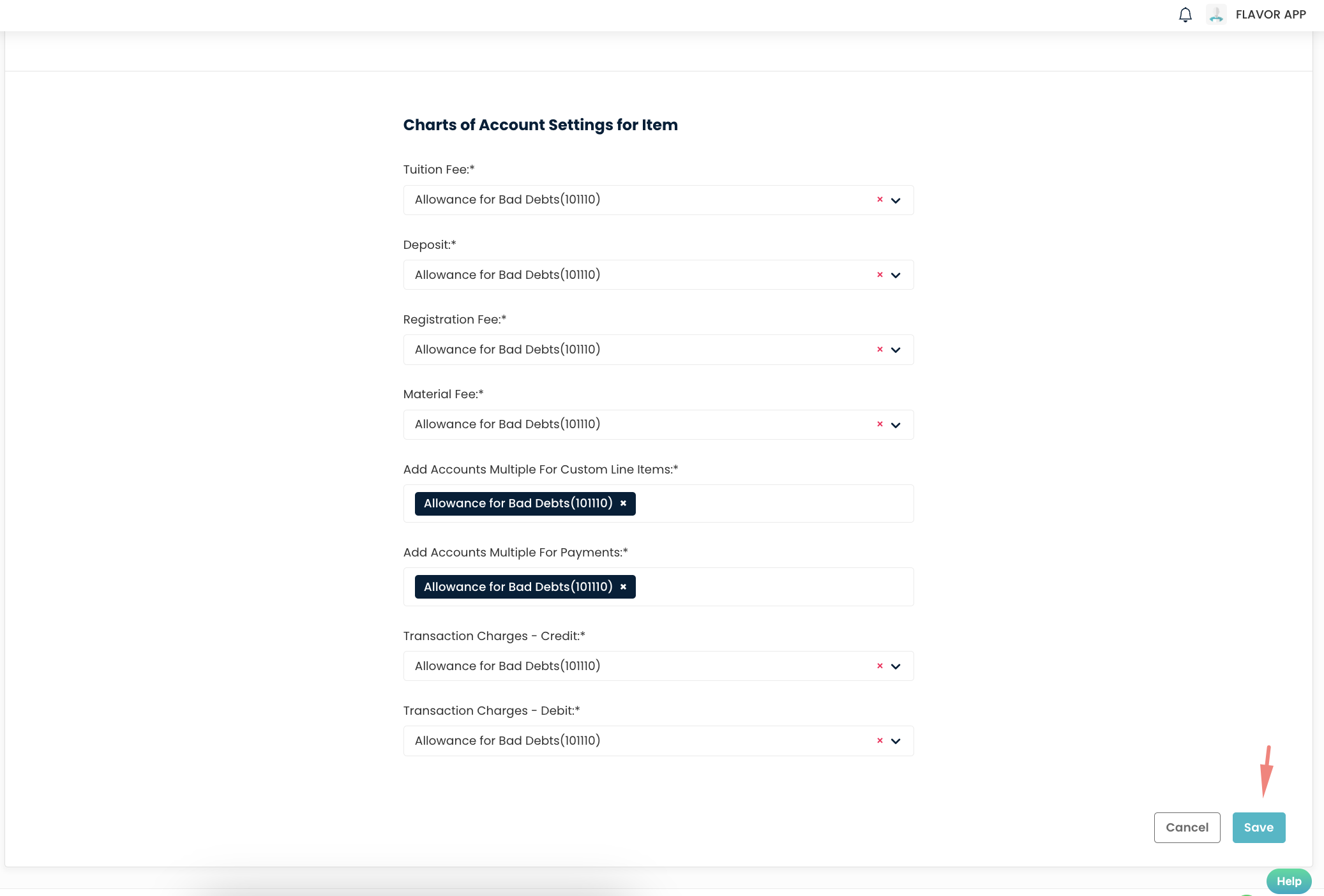

- Fill up the Chart of account setting for the item based on your setting.

- Click on save.

For the Metro detail you can check below guide link

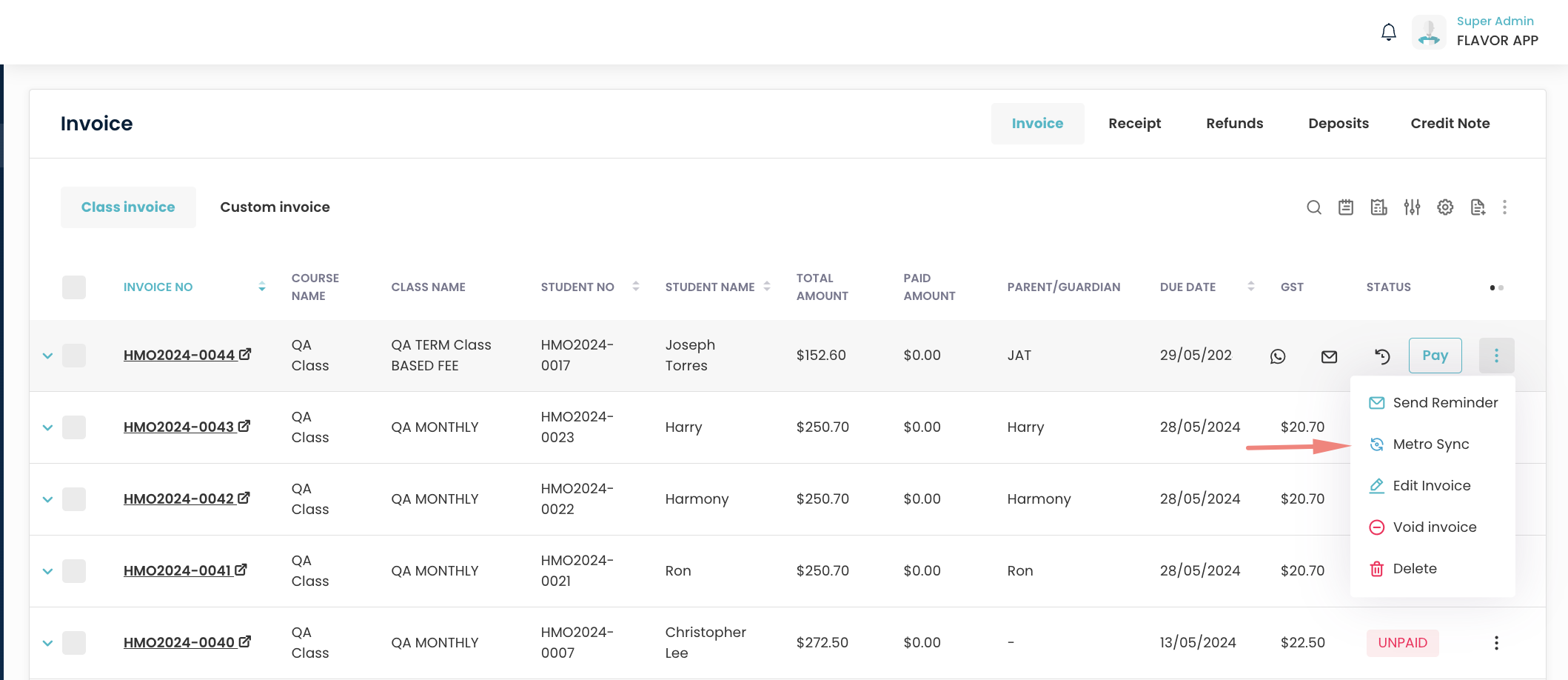

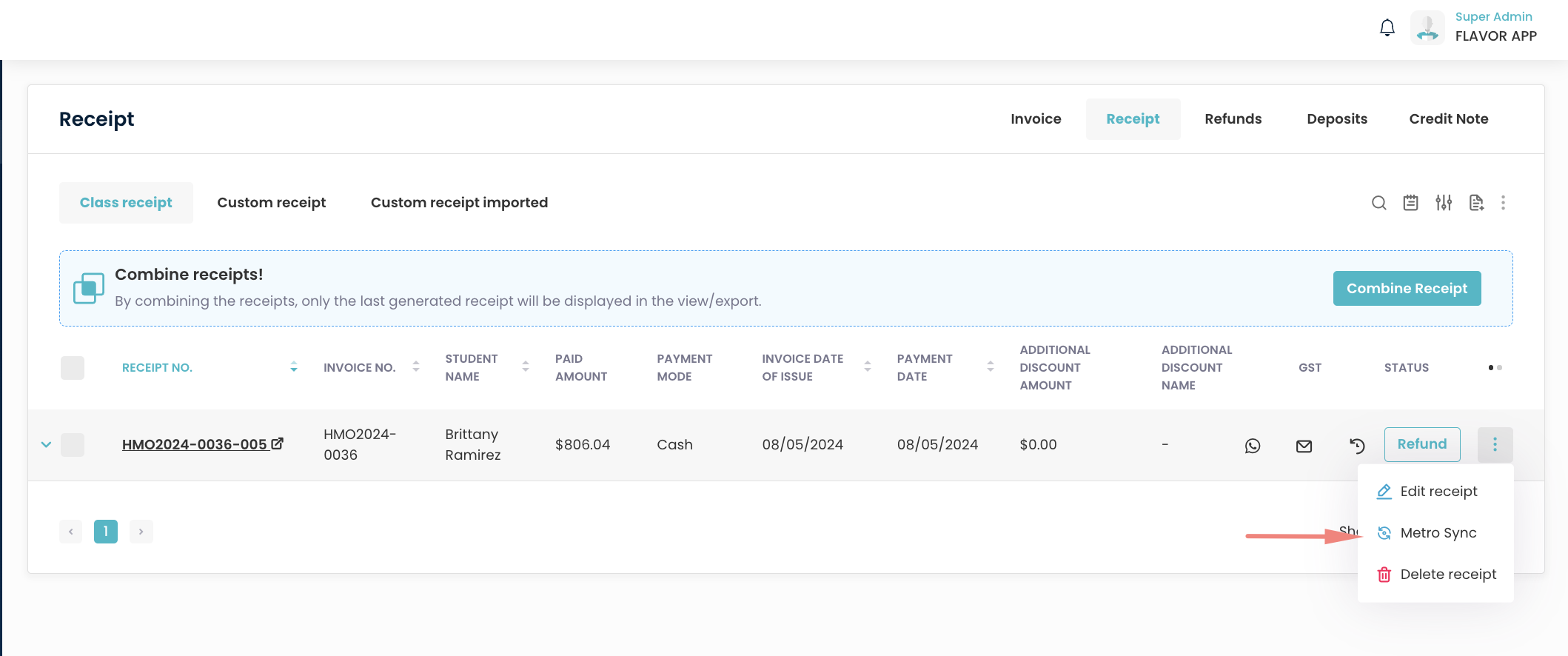

Once The Metro Accounting System setting is Saved, you can see the option to Sync Invoice & Receipt under the Payment Module.

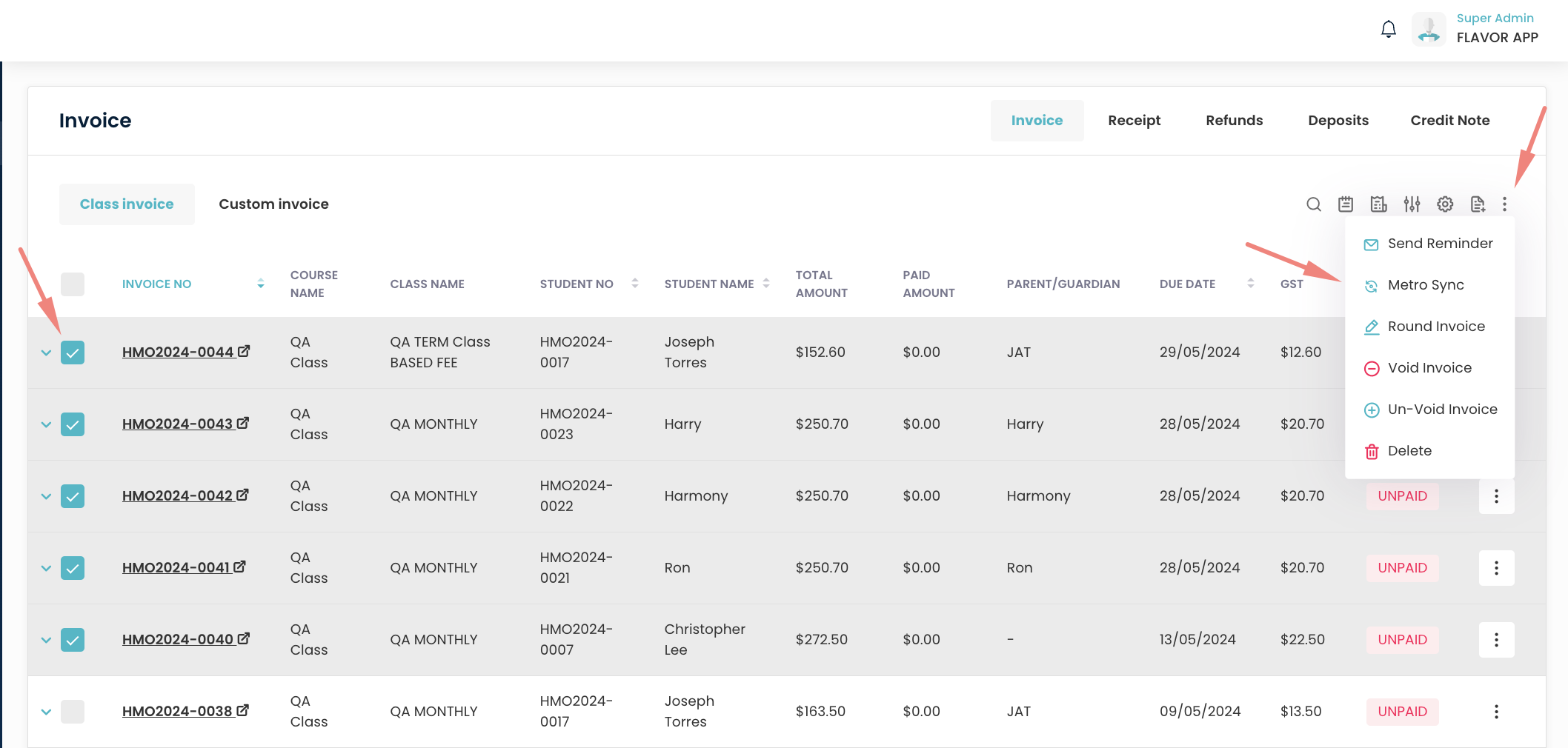

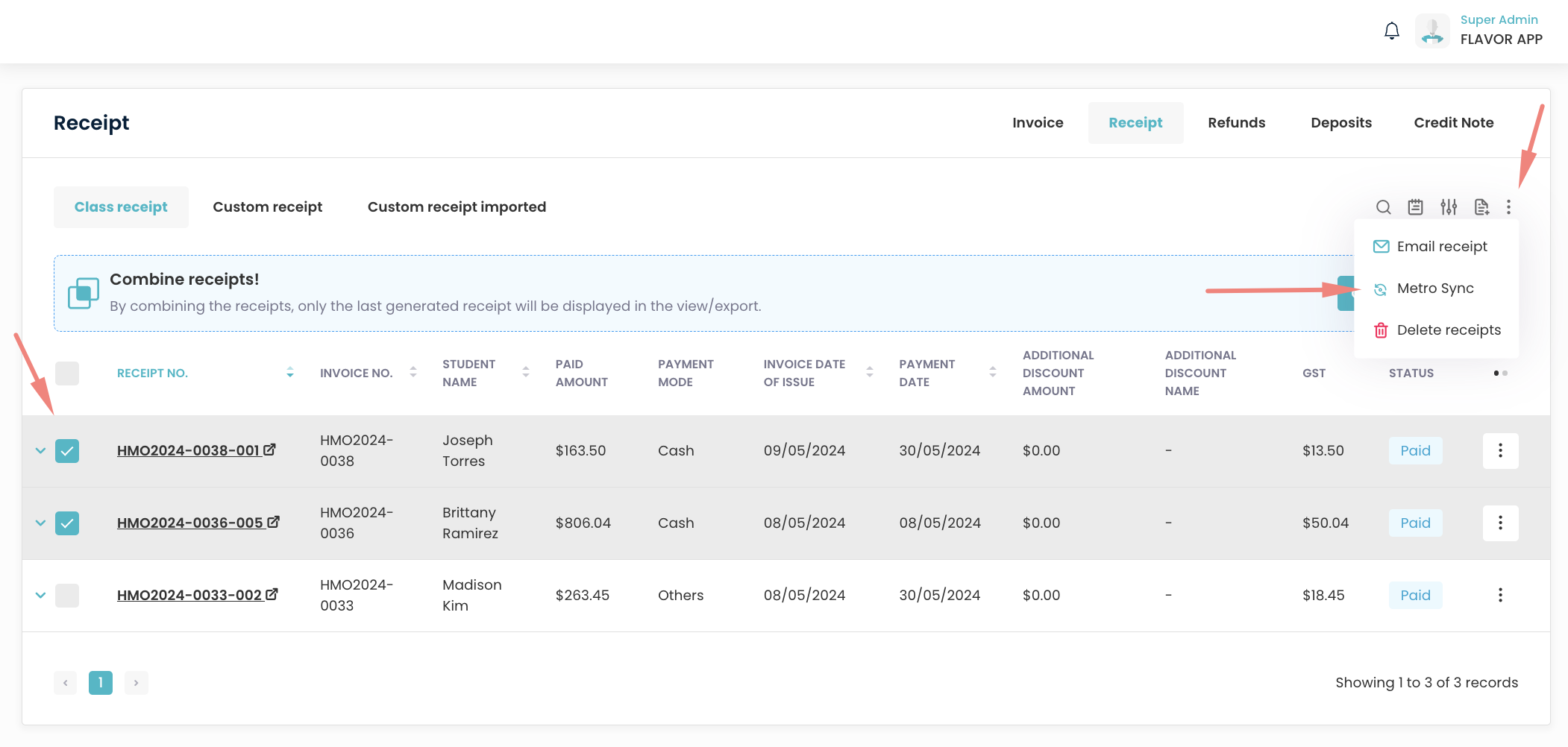

You can also sync multiple Invoices/Receipts by ticking it

Synced Invoice and receipt you can check in the Metro ERP system.

Need more help? Ask us a question

Please let us know more of your details and our team will reach out to you very shortly.